Navigating the World of Skincare and Health Savings Accounts (HSAs)

Related Articles: Navigating the World of Skincare and Health Savings Accounts (HSAs)

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the World of Skincare and Health Savings Accounts (HSAs). Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Skincare and Health Savings Accounts (HSAs)

The realm of healthcare expenses can be complex, with a multitude of accounts and regulations governing how individuals can manage their costs. Among these, Health Savings Accounts (HSAs) stand out as a powerful tool for individuals with high-deductible health plans. While HSAs are primarily associated with medical expenses, the question of whether skincare products qualify for HSA reimbursement often arises. This article aims to provide a comprehensive understanding of the relationship between HSAs and skincare purchases, shedding light on the nuances of this topic.

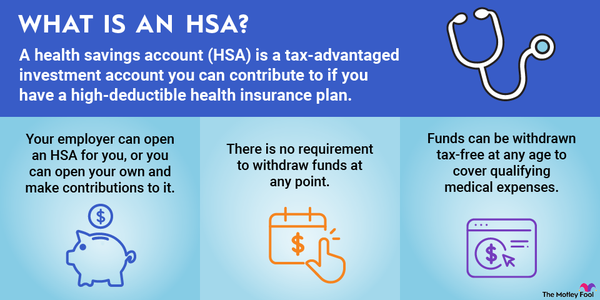

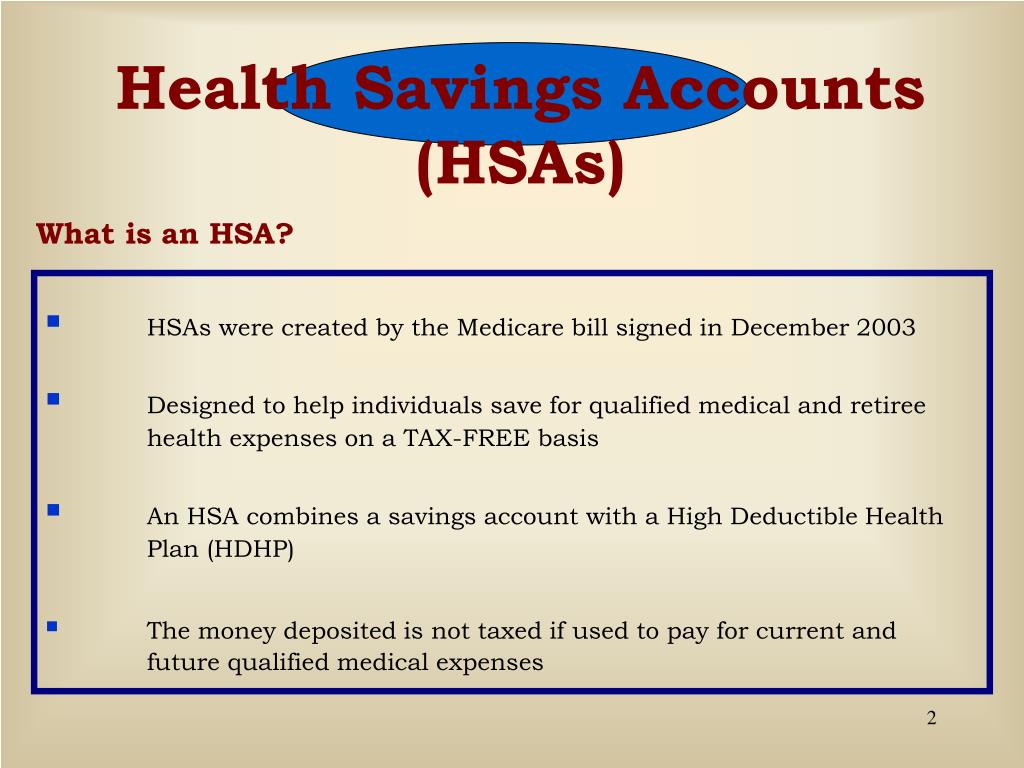

Understanding HSAs: A Primer

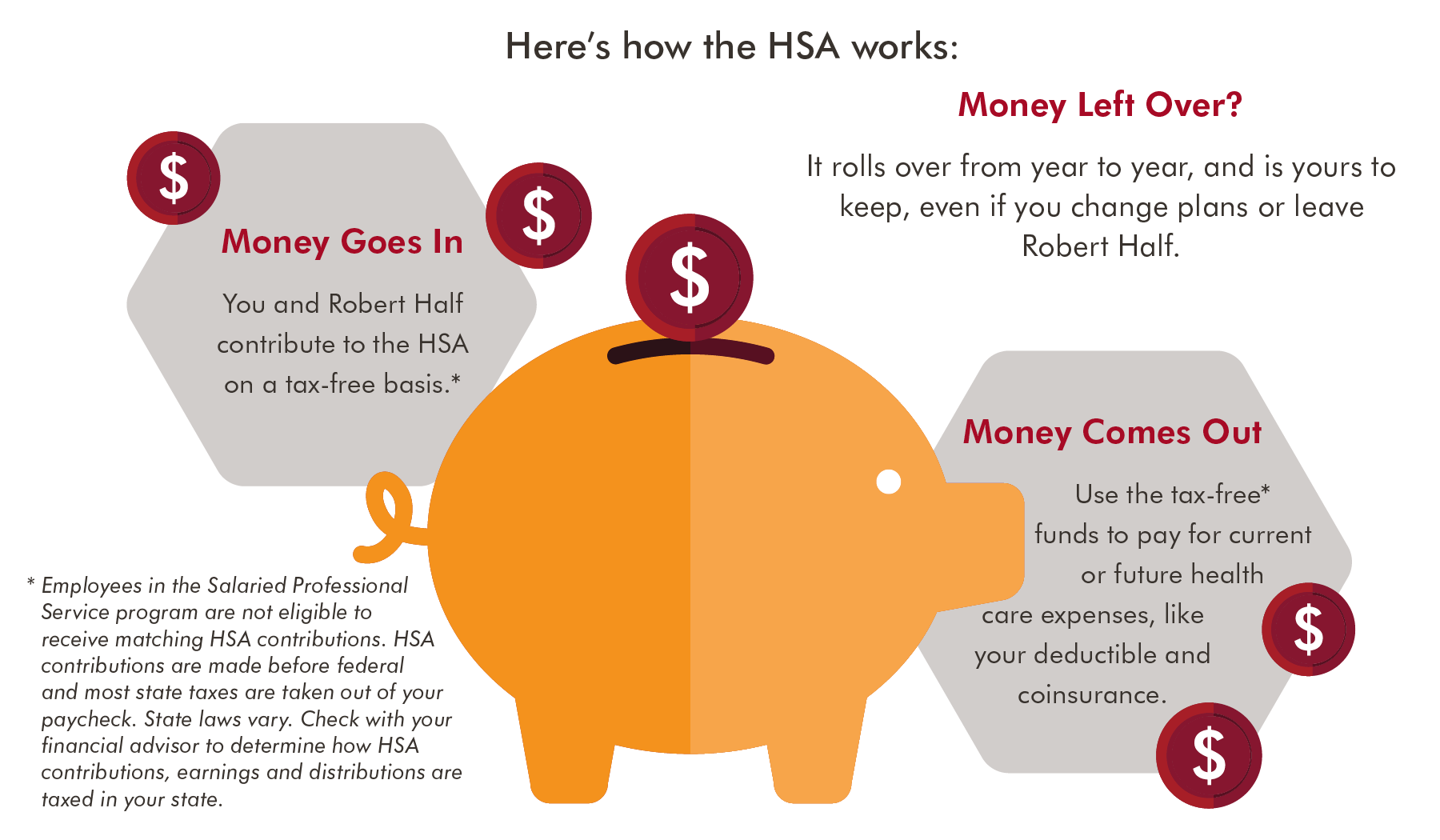

HSAs are tax-advantaged savings accounts designed for individuals enrolled in high-deductible health plans (HDHPs). These accounts allow individuals to save pre-tax dollars for eligible healthcare expenses, offering significant tax benefits. The funds in an HSA can be used for a wide range of medical expenses, including doctor’s visits, prescriptions, and even certain over-the-counter (OTC) medications.

Skincare and HSA Eligibility: A Delicate Balance

The eligibility of skincare products for HSA reimbursement hinges on their medical necessity. The Internal Revenue Service (IRS) defines eligible medical expenses as those incurred for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body.

Therefore, the key question becomes: Does the skincare product in question serve a medical purpose?

Navigating the Gray Area: Medical vs. Cosmetic

The line between medical and cosmetic skincare can be blurry. While many skincare products aim to enhance appearance, others are specifically designed to address medical conditions.

Examples of Medically Necessary Skincare:

- Prescription-strength topical medications: These are prescribed by a doctor to treat specific skin conditions like acne, eczema, psoriasis, or rosacea.

- Sun protection: Sunscreen is generally considered medically necessary to prevent skin cancer and other sun-related damage.

- Wound care products: These products, such as antibiotic ointments or dressings, are used to treat wounds and promote healing.

- Skincare for specific medical conditions: Products designed to manage conditions like eczema or psoriasis, often prescribed by a dermatologist.

Examples of Cosmetic Skincare:

- Moisturizers: While moisturizing can be beneficial for overall skin health, most moisturizers are not considered medically necessary.

- Anti-aging creams: These products aim to reduce wrinkles and fine lines, primarily focusing on aesthetic improvement.

- Skin-brightening products: Products designed to even skin tone and reduce hyperpigmentation are generally considered cosmetic.

- Makeup: Makeup is purely cosmetic and not eligible for HSA reimbursement.

The Importance of Documentation:

To ensure HSA reimbursement for skincare products, it is crucial to have proper documentation. A prescription from a doctor or dermatologist clearly stating the medical necessity of the product is often required. Additionally, receipts and invoices should be retained for potential audit purposes.

FAQs: Addressing Common Queries

Q: Can I use my HSA for skincare products I purchase online?

A: Yes, you can use your HSA for skincare products purchased online as long as the products are medically necessary and you have the required documentation.

Q: Can I use my HSA for skincare products purchased at a drugstore?

A: Yes, you can use your HSA for skincare products purchased at a drugstore, but ensure that the products are medically necessary and you have appropriate documentation.

Q: What if the skincare product is not explicitly labeled as "medically necessary"?

A: It is advisable to consult with a doctor or dermatologist to determine if the product’s intended use qualifies as medically necessary.

Q: Can I use my HSA for skincare products purchased outside the United States?

A: The eligibility of HSA expenses for purchases made outside the United States can vary. It is best to consult with your HSA provider or a tax advisor for specific guidance.

Tips for Maximizing HSA Benefits for Skincare:

- Consult with a dermatologist: Seek professional advice to determine which skincare products are medically necessary for your specific needs.

- Obtain a prescription: If possible, obtain a prescription for any skincare products that address a medical condition.

- Keep detailed records: Retain receipts and invoices for all skincare purchases made with HSA funds.

- Check with your HSA provider: Contact your HSA provider to confirm the specific guidelines and requirements for HSA-eligible skincare products.

Conclusion: A Prudent Approach to Skincare and HSAs

While the use of HSAs for skincare purchases can be a valuable benefit, it is essential to approach this with a clear understanding of the eligibility criteria. By carefully considering the medical necessity of skincare products, obtaining appropriate documentation, and consulting with healthcare professionals, individuals can maximize the benefits of their HSA while ensuring compliance with IRS regulations.

:max_bytes(150000):strip_icc()/Pros-and-cons-health-savings-account-hsa_final-32c82ecfb53340739b46e7bb0d13b18e.png)

%20FAQs_featured.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Skincare and Health Savings Accounts (HSAs). We hope you find this article informative and beneficial. See you in our next article!