Navigating the World of Cosmetics Products: A Guide to Harmonized System Codes

Related Articles: Navigating the World of Cosmetics Products: A Guide to Harmonized System Codes

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the World of Cosmetics Products: A Guide to Harmonized System Codes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Cosmetics Products: A Guide to Harmonized System Codes

The global trade in cosmetics products is a complex and intricate landscape, with a wide array of items ranging from everyday essentials to luxury brands. To ensure smooth and efficient international commerce, a standardized classification system is crucial. This is where the Harmonized System (HS) code comes into play.

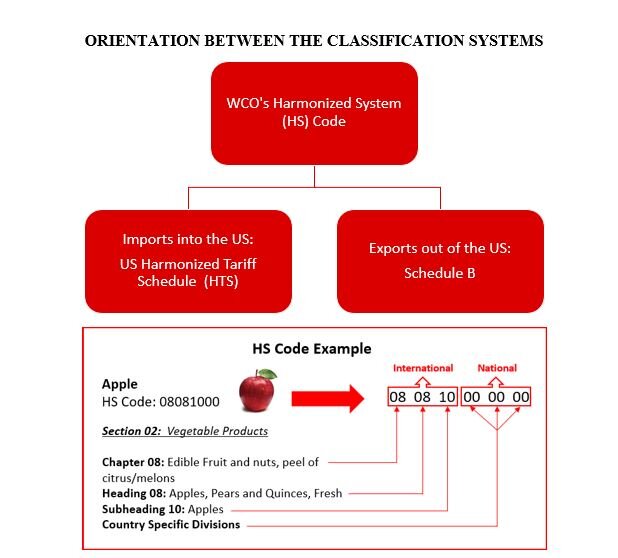

Understanding the Harmonized System (HS) Code

The HS code is a six-digit numerical code used to classify goods for international trade. It is a globally recognized system, adopted by over 200 countries and territories. The first two digits of the HS code represent the chapter, the next two digits represent the heading, and the last two digits represent the subheading. This hierarchical structure allows for a detailed and precise classification of products.

The Significance of HS Codes for Cosmetics Products

For cosmetics products, the HS code plays a vital role in:

- Tariff Determination: HS codes are the foundation for determining the applicable import and export tariffs. Different codes correspond to different duty rates, impacting the cost of goods and influencing trade decisions.

- Trade Statistics: Governments use HS codes to collect data on international trade flows. This information is essential for analyzing market trends, identifying potential trade barriers, and formulating trade policies.

- Customs Clearance: HS codes are used by customs authorities to identify and classify goods for clearance purposes. Accurate coding ensures efficient processing and reduces delays at borders.

- Product Labeling and Documentation: HS codes are often included on product labels and shipping documents, facilitating communication and compliance with international regulations.

Decoding the HS Codes for Cosmetics Products

Cosmetics products are primarily classified under Chapter 33 of the HS code, which covers "Perfumery, cosmetics or toilet preparations." This chapter encompasses a vast range of products, including:

- Perfumes and toilet waters: These are characterized by their fragrance and are typically applied to the body.

- Creams, lotions, and milks: These are designed for skincare, hair care, and other personal care applications.

- Shampoos, conditioners, and hair dyes: These are used for hair care and styling.

- Lipsticks, eyeshadows, and other makeup products: These are used for enhancing the appearance of the face and body.

- Dental hygiene products: These include toothpaste, mouthwash, and dental floss.

- Soaps and detergents: These are used for cleansing and washing.

Within Chapter 33, specific HS codes are assigned based on the product’s composition, function, and presentation. For instance, HS code 3304.00.00 covers "Perfumes and toilet waters," while HS code 3303.00.00 covers "Preparations for the care of the skin (other than medicaments)."

Navigating the Complexity: A Guide to Common HS Codes for Cosmetics Products

Here’s a breakdown of some commonly encountered HS codes for cosmetics products:

- HS Code 3301.00.00: "Essential oils and resinoids." This code covers essential oils extracted from plants, used as raw materials for perfumes and other cosmetics.

- HS Code 3302.00.00: "Perfume materials and preparations." This code covers various ingredients used in the production of perfumes and other fragrances, such as synthetic aroma chemicals and natural extracts.

- HS Code 3303.00.00: "Preparations for the care of the skin (other than medicaments)." This code encompasses a wide range of skincare products, including creams, lotions, toners, and masks.

- HS Code 3304.00.00: "Perfumes and toilet waters." This code covers perfumes, toilet waters, and other fragrant products designed for personal use.

- HS Code 3305.00.00: "Preparations for the care of the hair (other than medicaments)." This code covers shampoos, conditioners, hair dyes, and other hair care products.

- HS Code 3306.00.00: "Preparations for oral hygiene (other than medicaments)." This code covers toothpaste, mouthwash, dental floss, and other oral hygiene products.

- HS Code 3307.00.00: "Preparations for shaving or depilatory preparations." This code covers shaving creams, shaving gels, and depilatory products.

- HS Code 3304.00.00: "Soaps and detergents." This code covers soaps, detergents, and other cleansing products.

Frequently Asked Questions (FAQs) about Cosmetics Products HS Codes

Q: How do I find the correct HS code for a specific cosmetics product?

A: The best resource for finding the correct HS code is the Harmonized System Nomenclature (HSN) published by the World Customs Organization (WCO). You can access the HSN online or consult with a customs broker or trade expert.

Q: What happens if I use the wrong HS code?

A: Using the wrong HS code can lead to delays in customs clearance, incorrect tariff calculations, and potential penalties. It is crucial to ensure accuracy when classifying your products.

Q: Are there any resources available to help me determine the correct HS code?

A: Several resources can assist you in finding the correct HS code, including:

- World Customs Organization (WCO): The WCO website provides access to the HSN and other relevant documentation.

- National Customs Authorities: Each country’s customs authority has its own website and resources for finding HS codes.

- Trade Associations and Industry Experts: Trade associations and industry experts can provide guidance on specific HS codes for your products.

Tips for Utilizing HS Codes Effectively

- Stay Updated: The HS code system is regularly updated to reflect changes in trade patterns and product classifications. Stay informed about any revisions to ensure compliance.

- Consult Experts: If you are unsure about the correct HS code for your products, consult with a customs broker or trade expert for assistance.

- Maintain Accurate Documentation: Keep detailed records of the HS codes used for your products, including any supporting documentation.

- Seek Clarification: If you encounter any ambiguities or uncertainties regarding HS codes, contact the relevant customs authority for clarification.

Conclusion

The HS code plays a vital role in facilitating international trade in cosmetics products. By understanding the system and utilizing it effectively, businesses can streamline their operations, ensure compliance with regulations, and navigate the global marketplace with confidence. Accurate classification is crucial for smooth customs clearance, tariff determination, and data collection. By leveraging the available resources and seeking expert guidance, businesses can harness the power of HS codes to enhance their global trade endeavors.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Cosmetics Products: A Guide to Harmonized System Codes. We hope you find this article informative and beneficial. See you in our next article!