Navigating the Realm of Cosmetic Procedures and Health Savings Accounts: A Comprehensive Guide

Related Articles: Navigating the Realm of Cosmetic Procedures and Health Savings Accounts: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Realm of Cosmetic Procedures and Health Savings Accounts: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Realm of Cosmetic Procedures and Health Savings Accounts: A Comprehensive Guide

The allure of cosmetic procedures is undeniable. From wrinkle reduction to facial enhancements, these procedures promise to improve physical appearance and boost self-confidence. However, the financial burden associated with such treatments can be significant, prompting many individuals to explore avenues for cost-effective solutions. One such avenue that often sparks curiosity is the Health Savings Account (HSA).

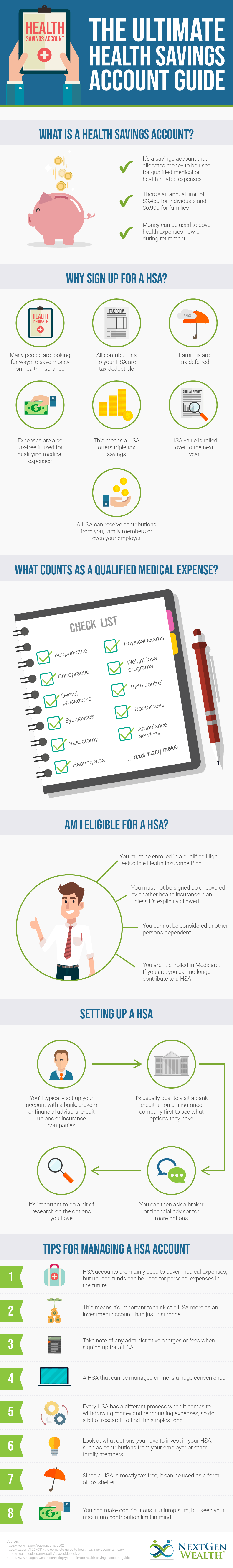

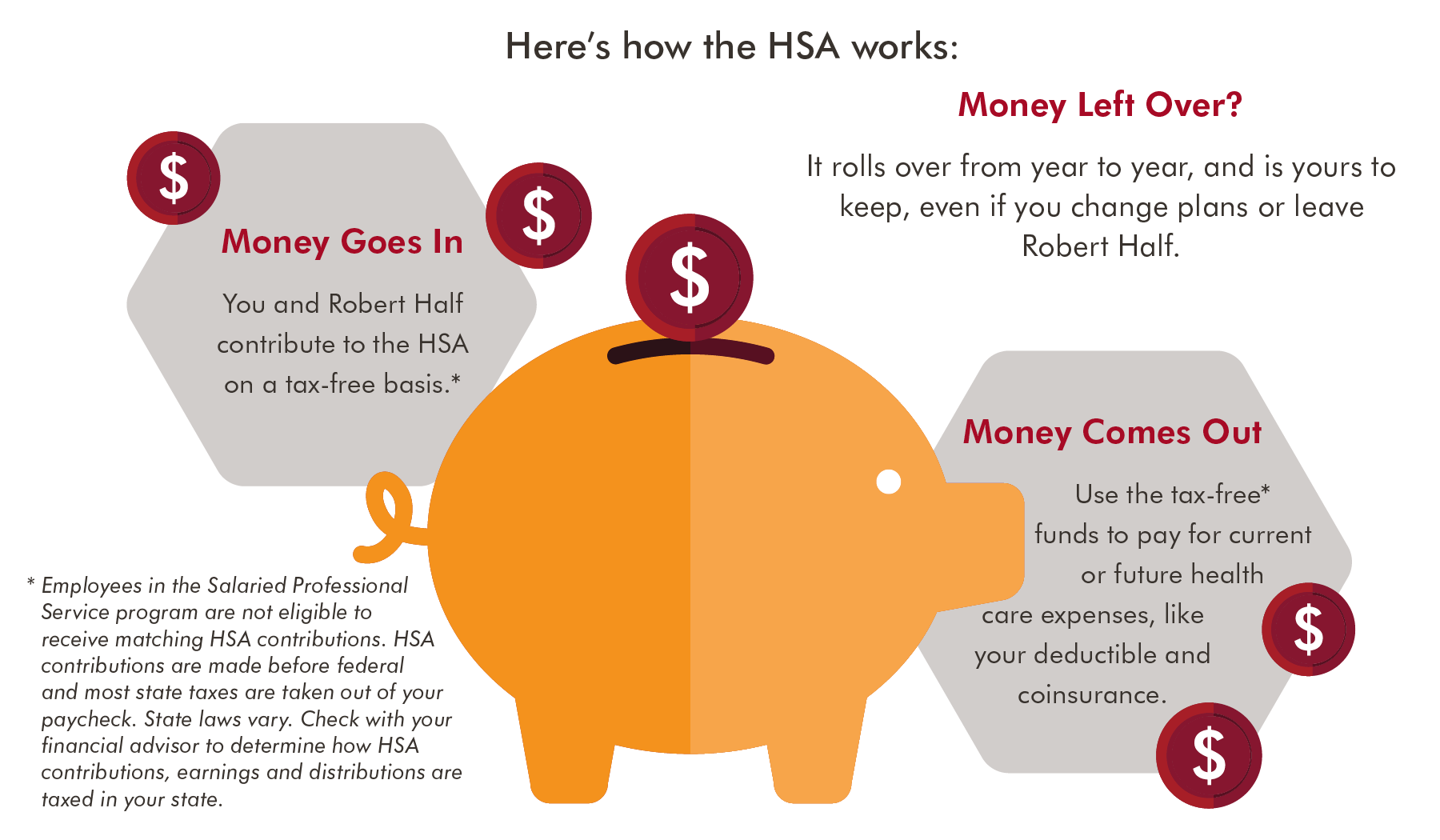

HSAs are tax-advantaged accounts designed to help individuals save for healthcare expenses. While their primary purpose is to cover eligible medical costs, the question of whether cosmetic procedures qualify for HSA reimbursement frequently arises.

Understanding HSA Eligibility: A Clear Distinction

The Internal Revenue Service (IRS) strictly defines eligible expenses for HSA reimbursement. These expenses must be medically necessary and related to the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body.

Cosmetic procedures, by their very nature, are primarily focused on enhancing appearance rather than addressing medical conditions. They generally fall outside the realm of medically necessary procedures and therefore are not eligible for reimbursement from HSAs.

Exceptions to the Rule: Where the Line Blurs

While cosmetic procedures are generally not eligible for HSA reimbursement, there are a few exceptions where the line between medical necessity and aesthetics blurs. These include:

- Reconstructive Surgery: Procedures performed to correct deformities or disfigurements resulting from congenital defects, accidents, or injuries are considered medically necessary and eligible for HSA reimbursement. This includes procedures addressing conditions like cleft lip, burns, or post-mastectomy breast reconstruction.

- Procedures for Medical Conditions: Certain cosmetic procedures may be considered medically necessary if they address a specific medical condition. For instance, rhinoplasty (nose surgery) may be eligible for HSA reimbursement if performed to correct a deviated septum, which can cause breathing difficulties.

- Procedures for Mental Health: In some cases, cosmetic procedures may be considered medically necessary if they address a mental health condition, such as body dysmorphic disorder (BDD). However, documentation from a qualified mental health professional is typically required to support the medical necessity of the procedure.

Navigating the Grey Areas: Seeking Guidance

Determining whether a specific cosmetic procedure qualifies for HSA reimbursement can be challenging. It is highly recommended to consult with a qualified healthcare professional and a tax advisor to understand the specific circumstances and applicable regulations.

FAQs: Addressing Common Concerns

Q: Can I use my HSA for laser hair removal?

A: Laser hair removal is generally considered a cosmetic procedure and not eligible for HSA reimbursement. However, if the procedure is performed to treat a medical condition, such as hirsutism (excessive hair growth), it might be eligible with proper documentation.

Q: Can I use my HSA for Botox injections?

A: Botox injections are primarily used for cosmetic purposes, such as wrinkle reduction, and are generally not eligible for HSA reimbursement. However, if the injections are used for a medical condition, such as migraines or excessive sweating, they may be eligible with proper documentation.

Q: What if my insurance covers a portion of the cosmetic procedure?

A: If your insurance covers a portion of the cosmetic procedure, the covered portion might be eligible for HSA reimbursement. However, the uncovered portion, which is considered the cosmetic aspect, would still be ineligible.

Tips for Navigating Cosmetic Procedures and HSAs

- Seek Professional Advice: Consult with a healthcare professional and a tax advisor to determine if a specific procedure qualifies for HSA reimbursement.

- Document Medical Necessity: If you believe a cosmetic procedure is medically necessary, obtain detailed documentation from your healthcare provider outlining the medical condition and the procedure’s necessity.

- Understand Insurance Coverage: Explore your insurance coverage for cosmetic procedures. While insurance may not cover the entire cost, it might cover a portion, making the remaining cost eligible for HSA reimbursement.

- Consider Alternative Financing Options: Explore alternative financing options, such as medical loans or payment plans, if the procedure is not eligible for HSA reimbursement.

Conclusion: Balancing Aesthetics and Financial Prudence

While the use of HSAs for cosmetic procedures is generally restricted, understanding the exceptions and seeking professional guidance can help individuals navigate the complex landscape of medical and cosmetic expenses. By carefully considering the medical necessity of procedures and exploring alternative financing options, individuals can make informed decisions that align with their financial goals and healthcare needs.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Realm of Cosmetic Procedures and Health Savings Accounts: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!