Navigating the Landscape of Healthcare Spending: Exploring the Coverage of Skincare Products with HSAs

Related Articles: Navigating the Landscape of Healthcare Spending: Exploring the Coverage of Skincare Products with HSAs

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Healthcare Spending: Exploring the Coverage of Skincare Products with HSAs. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Healthcare Spending: Exploring the Coverage of Skincare Products with HSAs

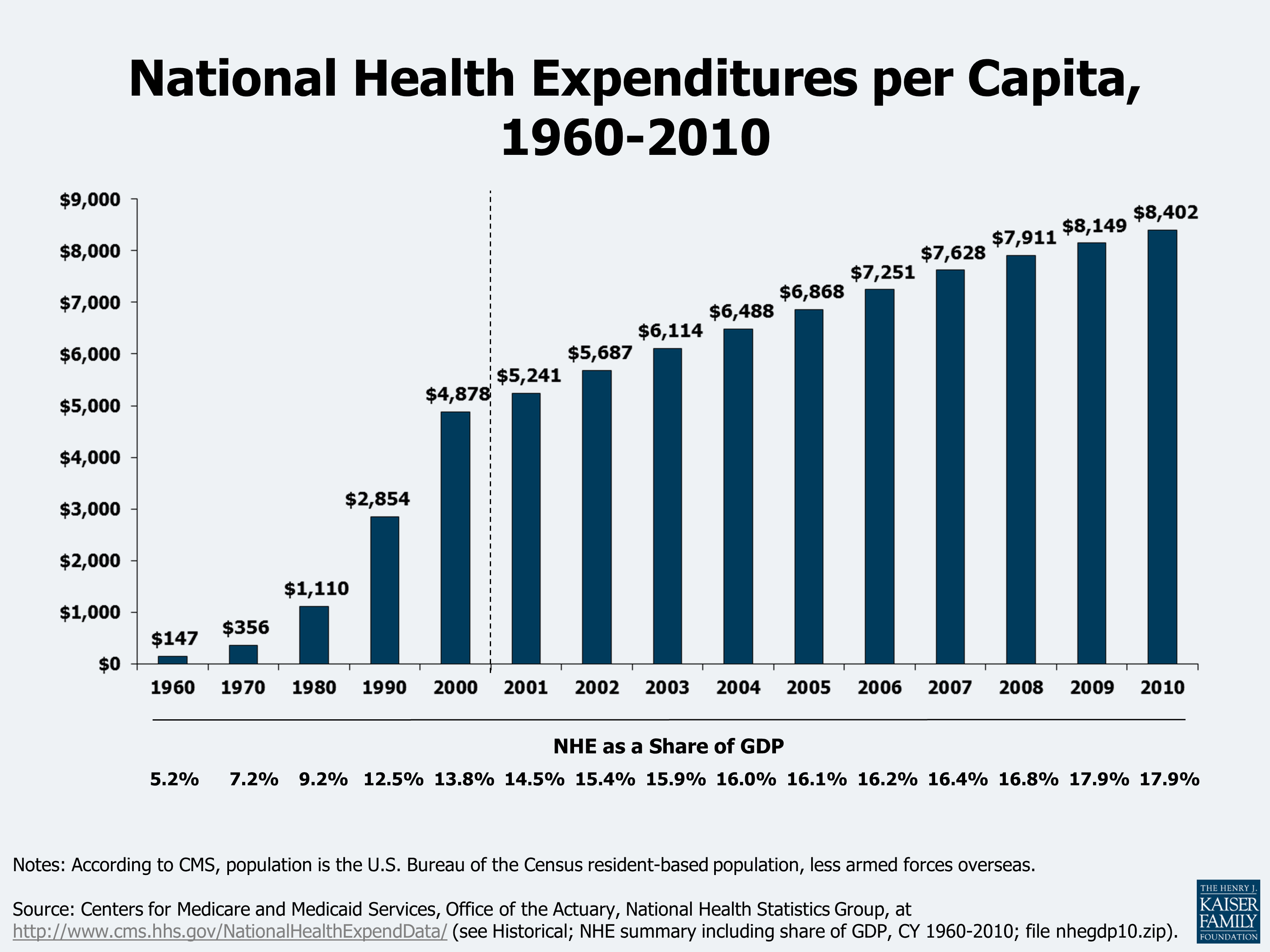

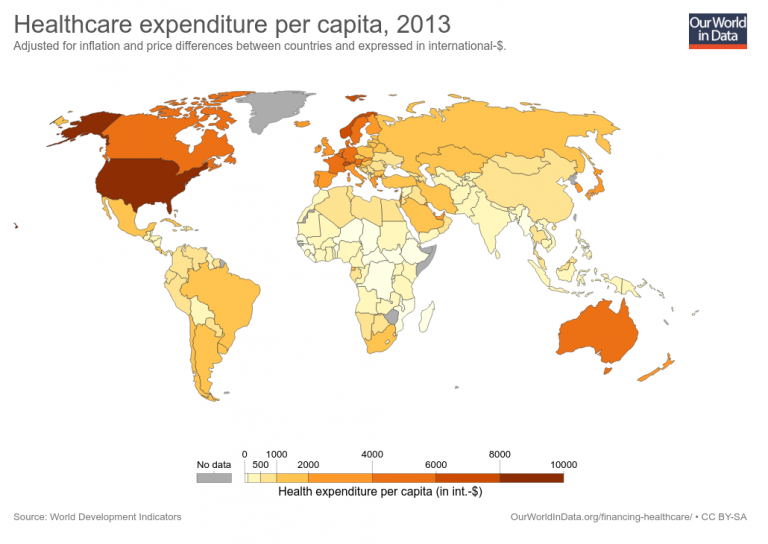

The rising cost of healthcare in the United States has prompted individuals to seek strategies for managing their medical expenses. Health Savings Accounts (HSAs) have emerged as a popular tool, offering tax advantages and flexibility in covering eligible medical costs. However, the question of whether skincare products qualify for HSA reimbursement often arises, leading to confusion and uncertainty. This article aims to shed light on the intricacies of HSA coverage for skincare, providing a comprehensive understanding of the relevant regulations and guidelines.

Understanding HSAs and Their Eligibility Criteria

Health Savings Accounts (HSAs) are tax-advantaged savings accounts specifically designed for individuals enrolled in high-deductible health plans (HDHPs). These accounts allow individuals to contribute pre-tax dollars, which accumulate interest tax-free. The funds can be used to pay for qualified medical expenses, including deductibles, copayments, and coinsurance.

The Internal Revenue Service (IRS) outlines a specific set of guidelines for determining eligible medical expenses that can be reimbursed through HSAs. These guidelines are based on the definition of "medical care" as outlined in Section 213 of the Internal Revenue Code. Generally, expenses are considered eligible if they are incurred for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body.

Skincare and the HSA Eligibility Spectrum

The question of whether skincare products qualify for HSA reimbursement hinges on the specific nature of the product and its intended use. While some skincare products are clearly considered medical expenses, others fall into a gray area, requiring careful consideration and interpretation of IRS guidelines.

Clearly Eligible Skincare Expenses

Several types of skincare products are explicitly recognized as eligible medical expenses by the IRS. These include:

- Prescription Medications for Skin Conditions: Products prescribed by a licensed medical professional to treat specific skin conditions, such as acne, eczema, psoriasis, or rosacea, are typically eligible for HSA reimbursement. This includes topical creams, ointments, and gels.

- Medical Devices for Skin Conditions: Devices prescribed for the treatment of skin conditions, such as bandages for wounds, compression garments for lymphedema, or light therapy devices for psoriasis, are generally considered eligible.

- Skin Cancer Treatment: Expenses associated with the diagnosis and treatment of skin cancer, including biopsies, surgery, chemotherapy, and radiation therapy, are covered by HSAs.

- Cosmetic Procedures for Medical Reasons: Some cosmetic procedures performed for medical reasons, such as reconstructive surgery after an accident or burn, or Mohs surgery for skin cancer, are eligible.

Gray Areas and the Importance of Documentation

The eligibility of certain skincare products remains unclear, requiring careful consideration and documentation to support claims for HSA reimbursement. These include:

- Over-the-Counter (OTC) Skincare Products: While some OTC products may be used to address mild skin conditions, their eligibility for HSA reimbursement is often debated. The IRS generally considers OTC products as non-medical expenses unless they are specifically prescribed by a physician for a diagnosed condition.

- Sunscreens: While sunscreens are essential for protecting the skin from harmful UV rays, their eligibility for HSA reimbursement is unclear. While some argue that sunscreens prevent skin cancer, others view them as preventative measures rather than treatments for existing conditions.

- Anti-Aging Products: Products marketed for anti-aging purposes, such as wrinkle creams and serums, are generally not considered eligible for HSA reimbursement, as they are primarily aimed at enhancing appearance rather than addressing medical conditions.

- Skincare Products for Cosmetic Purposes: Products solely intended for enhancing appearance, such as moisturizers, toners, cleansers, and makeup, are typically not considered eligible for HSA reimbursement.

Tips for Maximizing HSA Coverage for Skincare

To navigate the complexities of HSA eligibility for skincare, consider these practical tips:

- Seek Professional Guidance: Consult with a healthcare professional to determine if your skincare needs are medically necessary. A physician’s diagnosis and prescription can significantly strengthen your claim for HSA reimbursement.

- Maintain Detailed Records: Keep meticulous records of all skincare expenses, including receipts, invoices, and documentation from your healthcare provider. This will help you substantiate your claims for reimbursement.

- Consult with Your HSA Administrator: Contact your HSA administrator for specific guidelines and policies regarding skincare coverage. Their interpretation of IRS regulations may vary, so seeking their clarification is essential.

- Explore Alternative Payment Options: If your skincare expenses are not eligible for HSA reimbursement, consider exploring alternative payment options, such as flexible spending accounts (FSAs) or health reimbursement arrangements (HRAs).

- Stay Informed: Keep abreast of any changes in IRS regulations or HSA guidelines related to skincare coverage. This will help you make informed decisions about your HSA usage.

FAQs Regarding HSA Coverage for Skincare

Q: Can I use my HSA for sunscreen?

A: The eligibility of sunscreen for HSA reimbursement is uncertain. While some argue that sunscreens prevent skin cancer, others view them as preventative measures rather than treatments for existing conditions. Consult with your healthcare provider and HSA administrator for specific guidance.

Q: What if my dermatologist recommends an OTC product?

A: If your dermatologist specifically prescribes an OTC product for a diagnosed skin condition, it may be eligible for HSA reimbursement. However, documentation from your provider is crucial to support your claim.

Q: Can I use my HSA for cosmetic procedures?

A: Cosmetic procedures are generally not eligible for HSA reimbursement unless they are performed for medical reasons, such as reconstructive surgery after an accident or burn.

Q: What are the tax benefits of using an HSA?

A: Contributions to an HSA are tax-deductible, meaning you can reduce your taxable income. Funds grow tax-free and withdrawals for qualified medical expenses are tax-free.

Conclusion

The question of whether skincare products qualify for HSA reimbursement is complex and requires careful consideration of IRS regulations, individual circumstances, and professional guidance. While certain products are clearly eligible, others fall into a gray area, requiring documentation and justification. By understanding the eligibility criteria, seeking professional advice, and maintaining meticulous records, individuals can maximize their HSA benefits for legitimate medical expenses, including those related to skincare. Remember, staying informed about HSA guidelines and consulting with your HSA administrator is crucial to making informed decisions about your healthcare spending.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Healthcare Spending: Exploring the Coverage of Skincare Products with HSAs. We appreciate your attention to our article. See you in our next article!