Navigating the Landscape of Affordable Health Insurance in Lyon: A Comprehensive Guide

Related Articles: Navigating the Landscape of Affordable Health Insurance in Lyon: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Affordable Health Insurance in Lyon: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Affordable Health Insurance in Lyon: A Comprehensive Guide

Lyon, a vibrant city renowned for its rich history, cultural attractions, and bustling urban life, also presents residents with the challenge of navigating the complexities of health insurance. While access to quality healthcare is paramount, the cost of coverage can be a significant concern for individuals and families. This comprehensive guide aims to demystify the landscape of affordable health insurance in Lyon, providing insights into the available options, factors influencing cost, and strategies for securing the most suitable coverage.

Understanding the French Healthcare System: A Foundation for Affordable Coverage

France boasts a universal healthcare system known as Sécurité sociale, which provides a safety net for its citizens. This system guarantees access to essential medical care at a subsidized rate, with citizens contributing through payroll deductions. However, Sécurité sociale does not cover all medical expenses, leaving individuals responsible for a portion of the costs, known as ticket modérateur.

Navigating the World of Complementary Health Insurance (Mutuelle)

To bridge the gap left by Sécurité sociale, French citizens rely on complementary health insurance, commonly referred to as mutuelle. These private insurance plans offer coverage for a wider range of medical expenses, including:

- Dental care: Covering a significant portion of the cost of dental treatments, braces, and dentures.

- Optical care: Providing subsidies for eyeglasses, contact lenses, and eye exams.

- Hospitalization: Covering additional expenses incurred during hospitalization, such as private rooms and certain medical procedures.

- Prescription drugs: Offering financial assistance for the purchase of prescribed medications.

Factors Influencing the Cost of Health Insurance in Lyon

The cost of mutuelle in Lyon, like elsewhere in France, is influenced by several factors:

- Age: Younger individuals generally enjoy lower premiums due to their lower risk profile.

- Health status: Pre-existing conditions may lead to higher premiums, as insurers assess the potential for increased healthcare utilization.

- Coverage level: Comprehensive plans offering extensive benefits typically come with higher premiums than basic plans with limited coverage.

- Location: Urban areas like Lyon may have higher insurance costs compared to rural regions, reflecting factors like higher healthcare utilization and cost of living.

- Family size: Plans covering multiple individuals generally cost more than individual plans.

Finding Affordable Health Insurance in Lyon: A Multi-faceted Approach

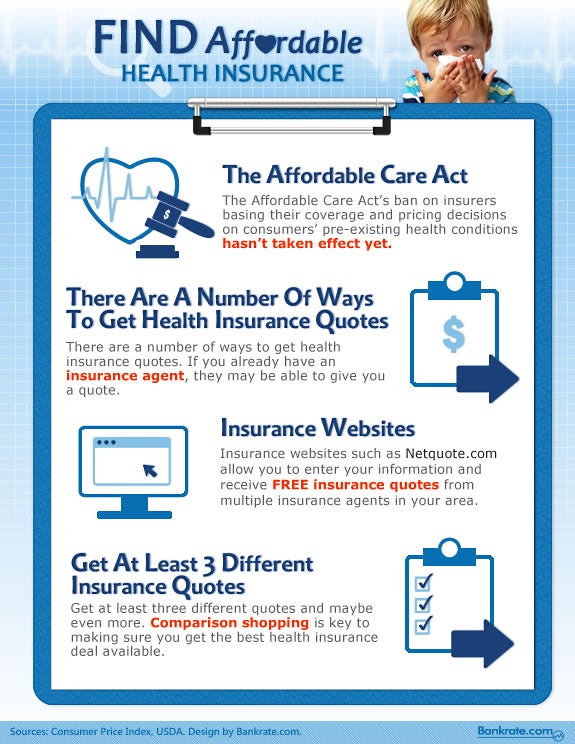

Finding affordable health insurance in Lyon requires a strategic approach:

- Compare quotes: Utilize online comparison platforms or consult with independent insurance brokers to obtain quotes from multiple insurers. This allows you to compare coverage levels, benefits, and premiums side-by-side.

- Consider group plans: If you are employed, explore the possibility of joining a group health insurance plan offered by your employer. These plans often provide more affordable premiums through economies of scale.

- Negotiate: Do not hesitate to negotiate with insurers, particularly if you have a clean health history and are willing to accept a plan with a lower level of coverage.

- Explore public assistance: For individuals with limited financial resources, explore eligibility for public assistance programs that may subsidize health insurance premiums.

- Reassess your needs: Periodically review your health insurance needs and adjust your coverage accordingly. If your health status or family situation changes, you may find that a different plan better suits your current requirements.

Frequently Asked Questions About Cheap Health Insurance in Lyon

1. What is the minimum amount I need to spend on health insurance in Lyon?

The minimum amount you need to spend on health insurance in Lyon depends on your individual needs and coverage preferences. However, basic mutuelle plans can be found for as low as €10-€20 per month. It is essential to remember that these plans may offer limited coverage and may not be suitable for individuals with pre-existing conditions or high healthcare utilization.

2. How can I find the best value for my health insurance in Lyon?

The best value for your health insurance in Lyon depends on your specific needs and budget. It is recommended to compare quotes from multiple insurers, considering factors such as coverage levels, benefits, and premiums. Consulting with an independent insurance broker can also provide valuable insights and guidance.

3. What are the consequences of not having health insurance in Lyon?

While France has a universal healthcare system, not having complementary health insurance can result in significant out-of-pocket expenses for medical care. It is essential to note that Sécurité sociale only covers a portion of medical costs, leaving individuals responsible for a substantial portion of the bill.

4. Can I switch health insurance providers in Lyon?

You can switch health insurance providers in Lyon at any time. However, there may be limitations or penalties associated with switching during the middle of a policy period. It is advisable to contact your current insurer to understand the terms and conditions of switching.

5. How can I ensure I am receiving the right level of health insurance coverage in Lyon?

To ensure you have the right level of coverage, consider your individual health needs, family situation, and budget. Consult with an insurance broker or healthcare professional to assess your requirements and choose a plan that provides adequate coverage for your specific circumstances.

Tips for Securing Affordable Health Insurance in Lyon

- Prioritize essential coverage: Focus on securing coverage for essential medical expenses such as hospitalizations, surgeries, and critical illnesses. Consider reducing coverage for less critical needs like dental or optical care to lower premiums.

- Consider a higher deductible: Opting for a higher deductible can lower your monthly premiums, as you agree to pay more out-of-pocket for smaller medical expenses.

- Explore discounts and promotions: Some insurers offer discounts for healthy lifestyles, group memberships, or loyalty programs. Inquire about these options to potentially lower your premiums.

- Stay informed about your rights: Familiarize yourself with the consumer rights and protections available to you as a health insurance policyholder in France. This will help you make informed decisions and navigate any potential disputes.

Conclusion

Securing affordable health insurance in Lyon is a crucial step towards ensuring access to quality healthcare. By understanding the French healthcare system, exploring the options available, and employing a strategic approach to finding the most suitable coverage, individuals and families can navigate the complexities of health insurance and gain peace of mind knowing they have the financial protection they need in case of unexpected medical expenses. Remember, healthcare is a fundamental human right, and access to affordable coverage should be a priority for all residents of Lyon.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Affordable Health Insurance in Lyon: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!